2-Methyl-4-Chlorophenoxyacetic Acid (MCPA) is a widely used selective herbicide belonging to the phenoxy family. Its primary function is to eliminate broadleaf weeds while leaving cereals and grasses unharmed. Developed in the 1940s, MCPA has gained global acceptance in the agricultural sector due to its affordability, effectiveness, and compatibility with integrated weed management practices. It is commonly applied to crops such as wheat, barley, rye, oats, rice, and sugarcane. MCPA also finds use in non-agricultural areas like lawns, golf courses, pastures, and along railway tracks.

MCPA works by mimicking the natural plant hormone auxin, disrupting cell growth and leading to the death of unwanted plants. Available in several formulations, including sodium salts, esters, and amine derivatives, MCPA’s versatility contributes significantly to its persistent demand across global markets. As the need for efficient crop production and weed control continues to rise, so does the relevance of MCPA in modern agriculture.

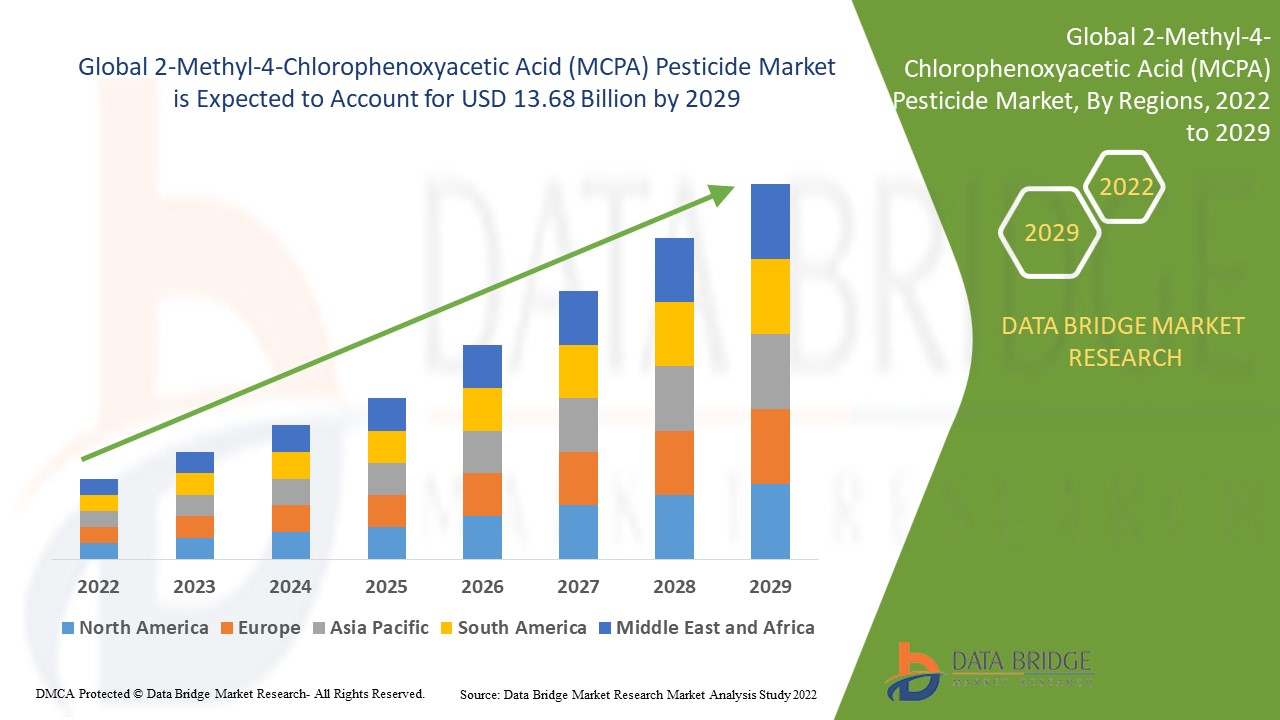

Data Bridge Market Research analyses that the 2-methyl-4-chlorophenoxyacetic acid (MCPA) pesticide market was valued at USD 11.9 billion in 2021 and is expected to reach the value of USD 13.68 billion by 2029, at a CAGR of 4.00% during the forecast period of 2022 to 2029.

Access Full 350 Pages PDF Report @

https://www.databridgemarketresearch.com/reports/global-mcpa-pesticide-market

Market Size

The global MCPA pesticide market was valued at approximately USD 320 million in 2024 and is expected to reach USD 420 million by 2029, growing at a CAGR of around 5.6%. The market’s expansion is driven by the increasing need for food production, advancements in herbicide technology, and the adoption of precision farming techniques. Asia-Pacific holds the largest market share, led by China and India, where agriculture plays a pivotal economic role and the pressure to increase crop yields is intensifying.

North America and Europe also represent substantial portions of the market, with widespread use of MCPA in grain production and turf management. The scalability of MCPA-based herbicides for both commercial agriculture and consumer lawn care has further expanded the global market’s value. Latin America, especially Brazil and Argentina, is emerging as a key growth region due to expanding agricultural land and supportive government policies.

Market Share

In terms of market segmentation, the agricultural sector contributes more than 80% of the overall demand for MCPA pesticides. Among crop types, cereals and grains dominate usage, with wheat and rice being the most significant. Herbicide manufacturers such as Nufarm, Corteva Agriscience, and BASF lead the global market, holding a combined share of over 40%. These companies offer a variety of MCPA formulations and invest heavily in R&D to enhance product efficiency and minimize environmental impact.

Formulation-wise, the MCPA amine salt and MCPA ester types are the most widely used due to their higher absorption rate and effectiveness in different environmental conditions. Liquid herbicides account for a major portion of market share due to ease of application, although dry formulations are gaining attention in water-scarce regions.

Market Opportunities and Challenges

The market presents several lucrative opportunities. The rising global population and the consequent increase in food demand are putting pressure on farmers to boost yields. MCPA enables effective weed management, which directly improves crop productivity. With climate change posing threats like irregular rainfall and droughts, the adoption of resilient crop protection strategies is gaining importance, and MCPA is positioned as a key tool in such frameworks.

There is also a growing opportunity in integrated pest and weed management systems. MCPA, being selective, is often integrated into eco-friendly weed control regimes that balance chemical, biological, and mechanical methods. Emerging markets in Africa and Southeast Asia offer significant growth potential due to increasing arable land, modernization of farming techniques, and greater awareness about weed control.

However, the market is not without challenges. Regulatory scrutiny over synthetic herbicides is tightening. The European Union and several other regions have imposed restrictions or additional compliance requirements for chemical herbicides, including MCPA. Environmental concerns regarding leaching, runoff, and soil toxicity may lead to stricter usage protocols.

Another key challenge lies in the development of herbicide-resistant weed species. Overuse of MCPA and similar chemicals has led to adaptive resistance in some broadleaf weeds, reducing the herbicide’s effectiveness and pushing research institutions and manufacturers to innovate continuously. Additionally, organic farming movements and consumer pushback against synthetic agrochemicals could limit long-term growth.

Market Demand

Demand for MCPA pesticides remains strong across both developed and developing nations. The herbicide’s affordability and targeted mode of action make it a go-to solution for medium- and large-scale farmers. In regions where mechanized farming is expanding, MCPA fits seamlessly into existing crop management systems.

Demand is particularly high in countries such as India, China, Brazil, the United States, and Canada. Seasonal crop cycles, especially in wheat and rice, drive repeat purchases. The global push for sustainable agriculture is also creating demand for low-toxicity, low-residue herbicides like MCPA, which breaks down relatively quickly in soil and poses minimal risk to non-target organisms when used correctly.

Non-agricultural demand is also contributing to market stability. MCPA is employed in public spaces, gardens, parks, and along transportation corridors for vegetation control. As urban landscapes continue to expand, so does the need for cost-effective and safe herbicidal solutions.

Market Trends

Several trends are shaping the future of the MCPA pesticide market. One significant trend is the shift toward eco-friendly formulations. Manufacturers are investing in biodegradable and low-volatility variants of MCPA to address environmental and regulatory concerns. This not only helps in meeting compliance standards but also appeals to sustainability-conscious consumers and institutions.

Digital farming is also influencing the market. Precision agriculture tools such as drones, satellite imagery, and GPS-based spraying systems are enhancing the targeted application of MCPA, reducing waste and maximizing efficiency. This technological integration is helping farmers reduce input costs while maintaining or improving yield quality.

Another noticeable trend is the consolidation within the agrochemical industry. Mergers and acquisitions among key players are resulting in larger portfolios, better distribution networks, and increased investment in research. These factors collectively enable the faster rollout of innovative products that improve the efficacy and safety of MCPA-based herbicides.

Finally, education and awareness programs initiated by governments and agricultural extension services are encouraging the responsible use of herbicides, helping prevent misuse and promoting best practices. As knowledge spreads, so does market maturity, especially in regions previously dependent on traditional or manual weed control methods.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975