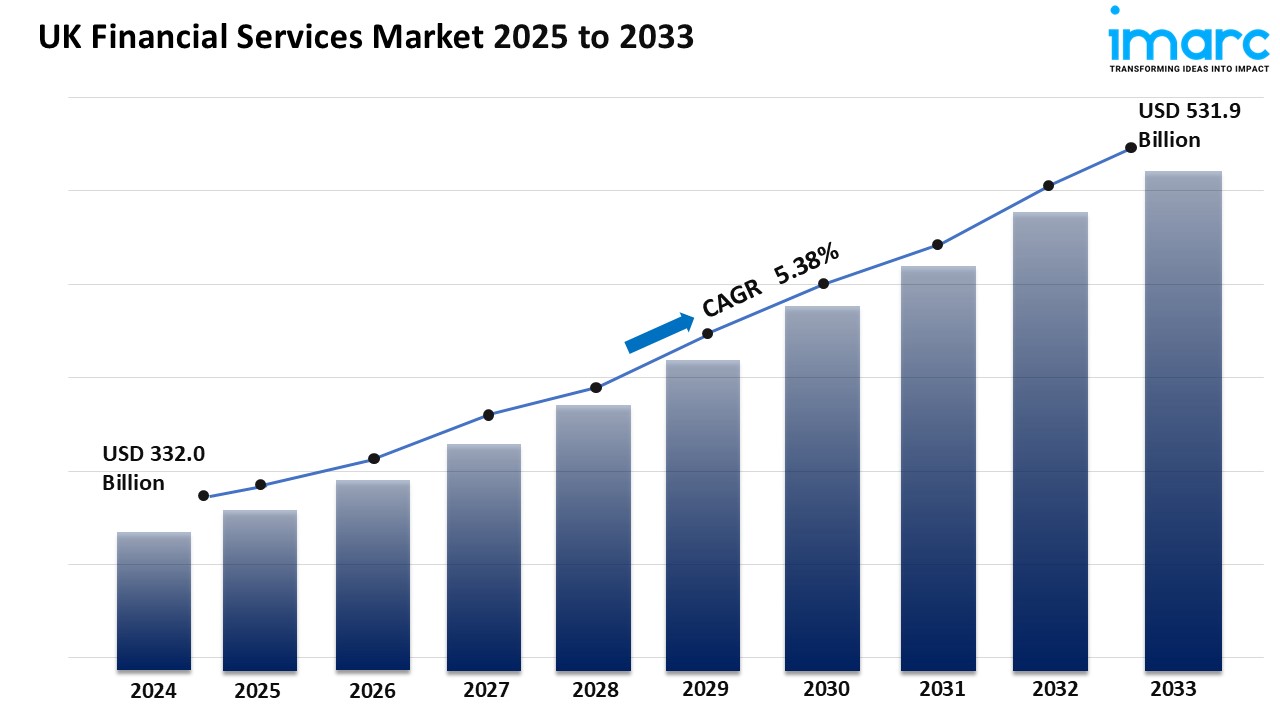

UK Financial Services Market Overview

Market Size in 2024: USD 332.0 Billion

Market Forecast in 2033: USD 531.9 Billion

Market Growth Rate 2025-2033: 5.38%

The UK financial services market size reached USD 332.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 531.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.38% during 2025-2033.

UK Financial Services Market Trends and Drivers:

The UK financial services market is witnessing a transformative phase, because it keeps evolving via deep-rooted sectoral integration, expanded virtual innovation, and a steadfast regulatory surroundings. Financial establishments are proactively embracing fintech answers to streamline operations, beautify patron engagement, and pressure value-primarily based totally services throughout banking, asset control, and coverage. With the United Kingdom keeping its function as a worldwide economic centre, establishments are strengthening their virtual infrastructure to supply seamless consumer reviews and data-pushed insights. The fast adoption of open banking, real-time payments, and AI-led advisory offerings is drastically improving economic accessibility and transparency. Moreover, as client expectancies develop for customized and handy offerings, economic carriers are integrating superior technology and automation to stay agile in an an increasing number of aggressive panorama. These structural upgrades are together maintaining long-time period marketplace momentum, reinforcing the country`s monetary resilience and worldwide management in economic innovation.

Across the United Kingdom, numerous drivers are reinforcing the electricity and scalability of the economic offerings ecosystem. Heightened call for for included virtual banking structures is gambling a crucial position in reshaping conventional carrier transport models. In parallel, institutional investments in cybersecurity and compliance are organising robust operational foundations, making sure client agree with and regulatory alignment. The UK`s strong prison framework and proactive economic guidelines are similarly incentivising cross-border investments and worldwide partnerships. This beneficial surroundings is encouraging fintech startups and legacy establishments alike to collaborate on modern answers, along with blockchain-enabled transactions, embedded finance models, and opportunity lending frameworks. Additionally, the coverage and reinsurance segments are present process virtual transformation, allowing dynamic pricing, chance assessment, and patron engagement strategies. These improvements aren’t simplest enriching client reviews however additionally catalysing the general diversification and modernisation of the economic panorama throughout nearby and metropolitan markets.

As the economic offerings marketplace withinside the UK keeps expanding, rising tendencies are developing new avenues for growth, specially in sustainable finance and virtual wealth control. The growing impact of ESG (Environmental, Social, and Governance) concepts is encouraging establishments to combine accountable funding practices, aligning portfolios with sustainable outcomes. Concurrently, purchasers are an increasing number of leveraging robo-advisory structures and decentralised finance equipment to optimise their wealth control journeys. Small and medium organizations also are taking advantage of tailor-made economic answers, along with scalable credit score offerings and cloud-primarily based totally accounting integrations. These traits are making economic offerings greater inclusive, efficient, and adaptive to evolving consumer needs. By fostering a lifestyle of innovation and responsiveness, the United Kingdom marketplace is paving the manner for long-time period prosperity, attracting each home and worldwide gamers keen to capitalise on its evolving virtual and regulatory ecosystem.

For an in-depth analysis, you can refer sample copy of the report:

https://www.imarcgroup.com/uk-financial-services-market/requestsample

UK Financial Services Market Industry Segmentation:

Type Insights:

- Lending and Payments

- Insurance

- Reinsurance and Insurance Brokerage

- Investments

- Foreign Exchange Services

Size of Business Insights:

- Small and Medium Business

- Large Business

End-User Insights:

- Individuals

- Corporates

- Government

- Investment Institution

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure:

https://www.imarcgroup.com/request?type=report&id=24809&flag=C

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145