Sometimes known as a salary slip or paycheck stub, a payslip is a paper an employer gives an employee detailing their earnings and deductions for a particular pay period. It is a crucial source of data on finances and income. However, new employees are not always sure about the contents of a payslip and how payslips work, which is why here, you will get to know all about the same.

Introduction to a PaySlip and its contents

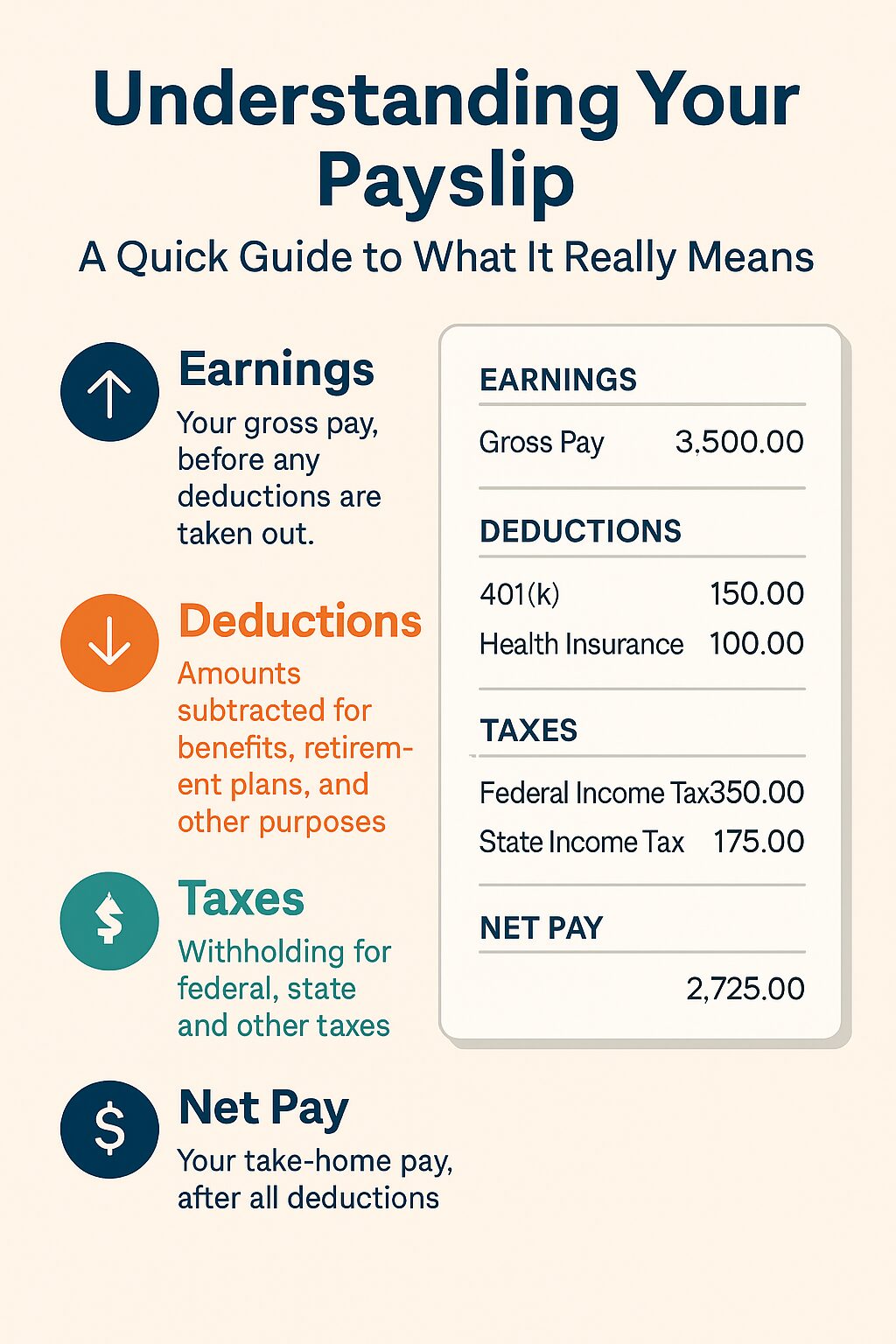

The basic elements of a typical payslip are the employee’s name, identification number, and pay period dates; gross pay (total earnings before deductions); net pay (take-home wage); and a breakdown of deductions including taxes, retirement contributions, insurance premiums, and other withholdings. It may also include compensation, overtime pay, or rewards.

Pay stubs not only enable staff members to keep track of their pay but also foster salary computation transparency. Filing taxes, applying for loans, and confirming past employment all call for them.

Many countries require employers to provide a payslip on a regular basis, whether in hard copy or online, under legal obligation.

In essence, a payslip is much more than just some standard document. It helps employees understand their pay, deductions, and net income calculation since it is a key financial document. Keeping track of your pay stubs will enable you to be more knowledgeable about your money and improve your financial stability.