Grow smarter with financial forecasting. Let accounting and bookkeeping service for startups guide your planning and boost long-term success.

For startups aiming to scale sustainably, guessing isn’t a strategy—forecasting is. Accurate financial predictions can guide smart decision-making, reduce risk, and unlock growth opportunities. That’s why partnering with the right accounting and bookkeeping service for startups is essential to setting up reliable financial forecasting tools from the beginning.

At Ceptrum, we help founders use forecasting not just to survive—but to scale with clarity and control.

Why You Need an Accounting and Bookkeeping Service for Startups

Startups deal with evolving revenue models, tight budgets, and rapid decision-making. With professional support, they can:

- Use historical data to project future cash flows

- Build flexible budgets

- Plan for taxes, hiring, or expansion

- Reduce financial uncertainty

At Ceptrum, our tailored solutions ensure that early-stage companies build smart systems from day one—empowering confident growth.

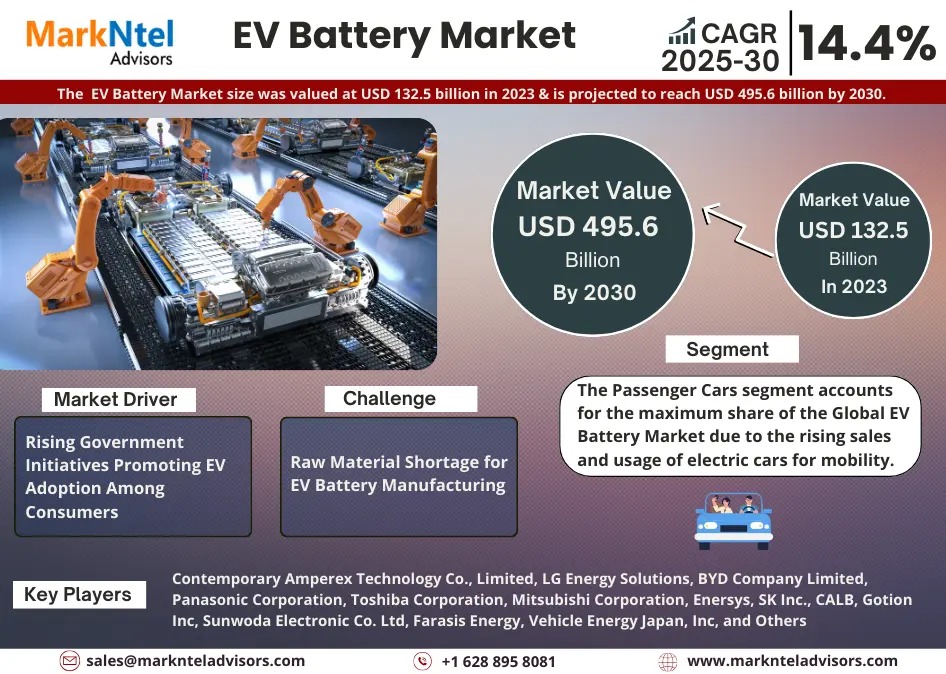

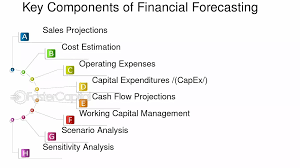

Key Elements of Financial Forecasting for Startups

Here’s how you can make forecasting work for your business:

1. Sales Projections That Guide Growth

Use previous sales data, marketing plans, and current market trends to estimate future revenue. If you’re just starting, use industry benchmarks or pilot campaign results to create realistic short-term targets.

Pro Tip: Update forecasts monthly or quarterly to keep pace with changing market conditions.

2. Expense Planning and Budgeting

Forecasting isn’t just about revenue—it’s also about controlling spending. Break down:

- Fixed expenses: rent, software, salaries

- Variable costs: materials, shipping, commissions

- One-time or seasonal costs

Accurate budgeting helps prevent overspending and ensures you always have a cash buffer.

3. Cash Flow Forecasting

Cash flow shows how much money is moving in and out of your business each month. Even profitable businesses can run into trouble without strong cash management.

At Ceptrum, we build automated bookkeeping systems that track every rupee—so you can project cash inflows and outflows with confidence.

4. Scenario Planning for Smarter Decisions

What happens if you lose your biggest client? Or hit 2x your sales target?

Scenario forecasting prepares you for best- and worst-case situations. This supports proactive decisions in hiring, investing, or pivoting your strategy.

5. Identifying Funding Needs

Financial forecasting helps pinpoint when and how much funding you might need. It also helps you present strong financials to banks and investors, increasing your chances of securing capital.

Using Ceptrum’s accounting tools, startups can create investor-ready reports with professional polish.

6. Aligning Forecasts with Business Goals

Every number should support a bigger vision. Financial forecasting is more than spreadsheets—it’s a roadmap to your milestones, whether that’s hitting a revenue target, launching a product, or opening a second location.

Final Thought:

Forecasting doesn’t eliminate uncertainty—but it gives you control over what’s coming next. With help from a specialized accounting and bookkeeping service for startups like Ceptrum, you gain the insights, tools, and confidence needed to grow boldly and wisely.

Ready to forecast your future with precision?

Let Ceptrum guide your startup with the financial clarity it deserves.